Risk Disclaimer

Trading futures, forex, and other financial instruments involves substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results. The content on this site is for educational purposes only and does not constitute financial advice. Always consult with a licensed financial advisor before making trading decisions.

VaderDan

Expert TraderProfessional trader specializing in Candle Range Theory (CRT), Wyckoff Method, and institutional order flow analysis. Helping traders master prop firm challenges and develop consistent trading strategies.

Point & Figure Counting Simplified: Predicting Price Targets Like Wyckoff

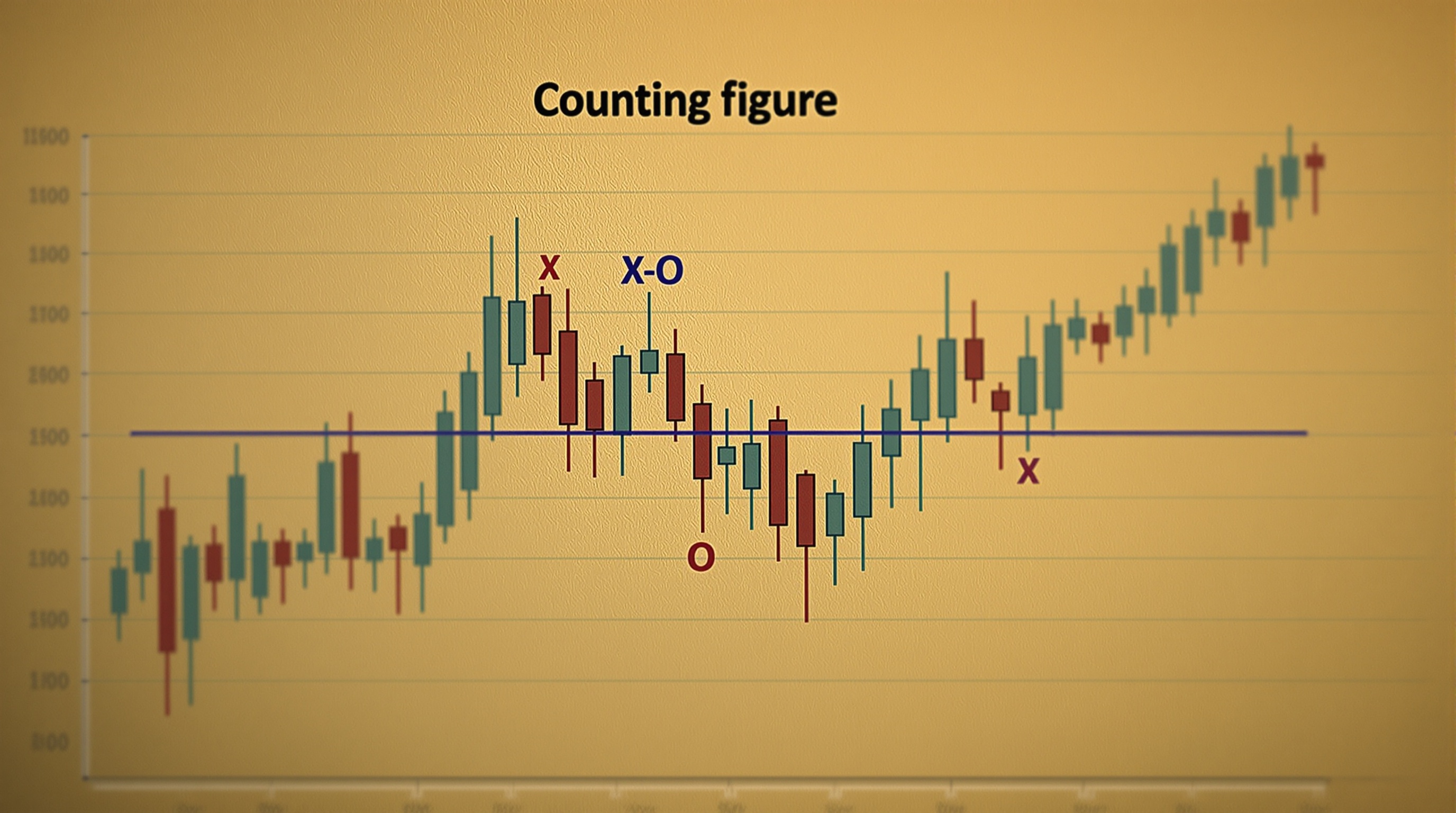

Want to know where price is headed? Point & Figure counting gives you objective price targets based on the size of accumulation or distribution. It's like measuring the fuel in the tank before the move.

What Is Point & Figure Counting?

Imagine you're measuring how far a rubber band will snap back after you stretch it. The more you stretch it, the farther it will fly back when released.

Point & Figure counting works the same way. It measures how much "energy" smart money has built up during accumulation or distribution phases, then calculates how far price is likely to move when that energy is released.

Key Principle: The longer and wider the accumulation/distribution phase, the bigger the subsequent price move will be.

Why Point & Figure Matters

Most traders guess at their profit targets. They might say "I'll take profits at the next resistance level" without any scientific basis. Point & Figure counting gives you:

- Realistic targets: Based on the actual "fuel" built up in the range

- Multiple target levels: Conservative, moderate, and aggressive targets

- Trade management: Know when to take profits and when to hold

- Risk assessment: Measure if the reward justifies the risk

The Simplified Counting Method

Traditional Point & Figure can be complex. Here's the simplified version that works for modern trading:

Step 1: Identify the Base

The "base" is your accumulation or distribution range. Measure:

- Width: Distance from support to resistance

- Time: How long price stayed in the range

- Activity: Number of times price tested the levels

Example: EUR/USD Accumulation Base

Support: 1.0800

Resistance: 1.0900

Width: 100 pips

Duration: 4 weeks

Tests: 6 support tests, 4 resistance tests

Step 2: Apply the Basic Count

Use this simplified formula:

Basic Target = Base Width × Count Factor

Conservative

Width × 1.0

Equal to base width

Moderate

Width × 1.5

1.5x base width

Aggressive

Width × 2.0

2x base width

Step 3: Calculate Your Targets

EUR/USD Target Calculation

- Range: 1.0800 - 1.0900 (100 pips wide)

- Breakout point: 1.0900 (resistance break)

- Direction: Bullish (accumulation completed)

- Conservative: 1.0900 + 100 pips = 1.1000

- Moderate: 1.0900 + 150 pips = 1.1050

- Aggressive: 1.0900 + 200 pips = 1.1100

Advanced Counting Factors

Adjust your count based on these factors:

Time Factor

- Quick ranges (1-2 weeks): Use 1.0x multiplier

- Normal ranges (3-6 weeks): Use 1.5x multiplier

- Extended ranges (7+ weeks): Use 2.0x or higher

Activity Factor

- Few tests (3-5): Standard multipliers

- Moderate tests (6-8): Add 0.2x to multipliers

- Many tests (9+): Add 0.5x to multipliers

Volume Factor

- Low volume range: Reduce targets by 25%

- Normal volume range: Use standard targets

- High volume range: Increase targets by 25%

Practical Trading Applications

Profit Taking Strategy

- 25% at Conservative target: Lock in guaranteed profits

- 50% at Moderate target: Take the majority of profits

- 25% at Aggressive target: Let runners capture extended moves

Stop Loss Positioning

Your stop loss should be:

- Accumulation trades: Below the spring low

- Distribution trades: Above the upthrust high

- Risk-reward check: Ensure conservative target gives minimum 2:1 ratio

Common Counting Scenarios

Scenario 1: Strong Accumulation

Setup: 6-week accumulation, high volume, multiple spring tests

Base width: 200 pips

Multiplier: 2.0x (extended time + high activity)

Conservative target: 200 pips

Aggressive target: 400 pips

Scenario 2: Quick Distribution

Setup: 2-week distribution, normal volume, few tests

Base width: 150 pips

Multiplier: 1.0x (quick range + low activity)

Conservative target: 150 pips down

Aggressive target: 150 pips down

Integration with Modern Tools

Combining with CRT

- Use P&F targets as: Final destinations for CRT trades

- CRT levels become: Profit-taking zones on the way to P&F targets

- Order blocks at P&F targets: Often provide excellent reversal points

Modern Timeframes

Adapt P&F counting to modern trading:

- Daily charts: For swing trading (multi-day holds)

- 4-hour charts: For day trading extensions

- 1-hour charts: For intraday scalping targets

Validation Techniques

Check Against Fibonacci

Your P&F targets should align reasonably with Fibonacci extensions:

- Conservative: Often near 127% extension

- Moderate: Often near 162% extension

- Aggressive: Often near 200% or 262% extension

Historical Analysis

Look at past similar ranges on the same instrument:

- Similar width ranges: How far did they typically move?

- Similar duration: What multipliers worked historically?

- Market conditions: Trending vs. ranging markets

Common Mistakes to Avoid

❌ Mechanical Application

Don't blindly apply formulas. Consider market conditions, news events, and overall trend strength.

❌ Ignoring Market Structure

If your target hits a major resistance level, expect price to struggle there regardless of the count.

❌ Unrealistic Expectations

P&F gives you probabilities, not guarantees. Market conditions can change and invalidate counts.

Key Takeaways

- ✓P&F counting measures the "energy" built up in accumulation/distribution phases

- ✓Use conservative (1x), moderate (1.5x), and aggressive (2x) multipliers

- ✓Adjust counts based on time, activity, and volume factors

- ✓Take profits in stages: 25% at conservative, 50% at moderate, 25% at aggressive

- ✓Validate targets against market structure and historical precedent

Complete Your Wyckoff Education

You now have all 6 simplified Wyckoff articles. Ready to explore the complete Wyckoff + CRT learning hub with additional resources?

Back to Wyckoff CRT Hub →