Risk Disclaimer

Trading futures, forex, and other financial instruments involves substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results. The content on this site is for educational purposes only and does not constitute financial advice. Always consult with a licensed financial advisor before making trading decisions.

VaderDan

Expert TraderProfessional trader specializing in Candle Range Theory (CRT), Wyckoff Method, and institutional order flow analysis. Helping traders master prop firm challenges and develop consistent trading strategies.

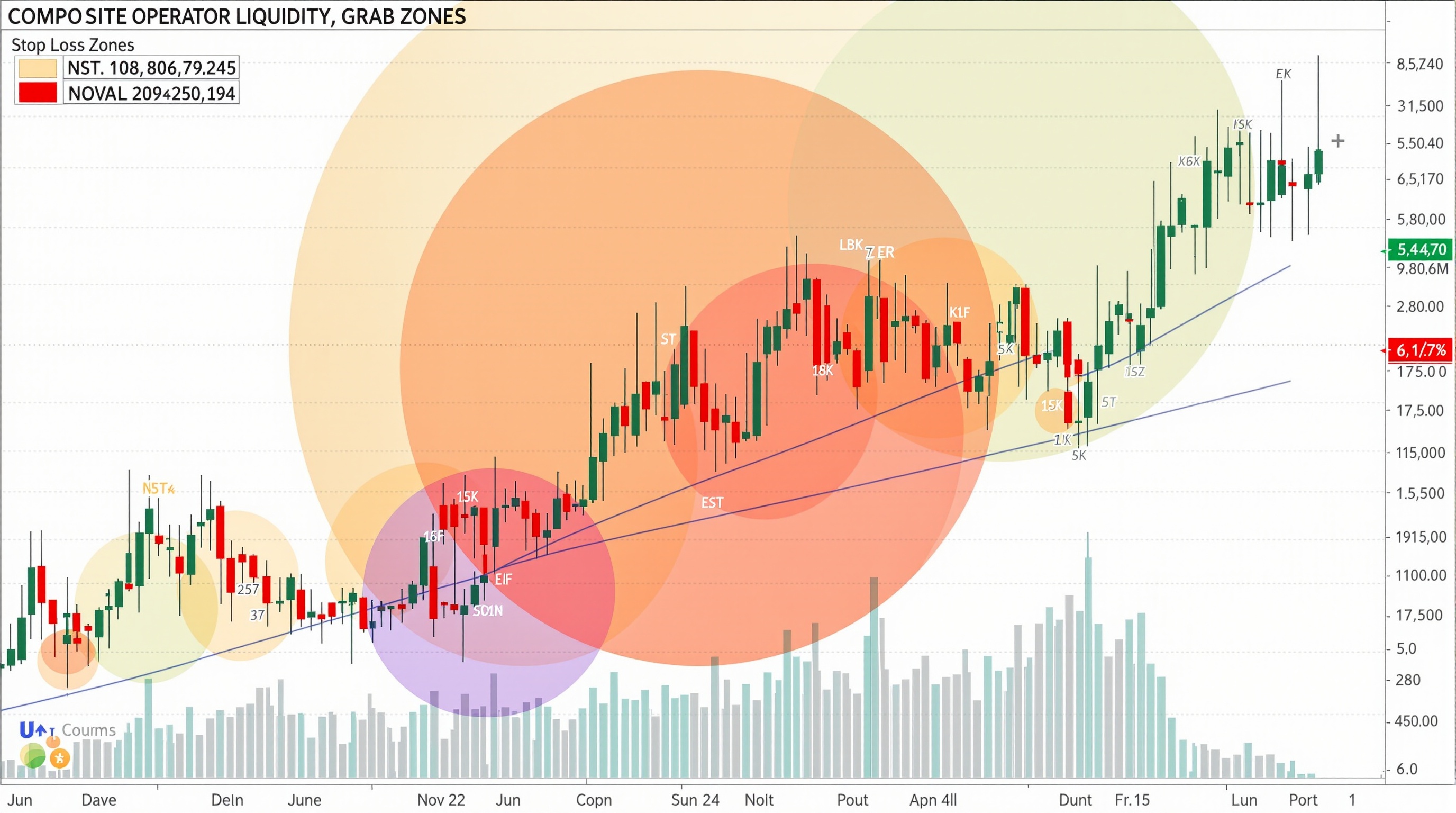

Liquidity Grab Strategy: Trading the Stop Hunt

Learn how to identify and profit from institutional liquidity grabs and stop hunts that occur at the beginning of major trading sessions.

Understanding Liquidity Grabs

A liquidity grab (also called a stop hunt) occurs when price briefly spikes through a key level to trigger stop losses, then quickly reverses in the opposite direction. This is not random market noise—it's a deliberate institutional strategy to fill large orders at favorable prices.

Institutions need liquidity to execute their massive orders. When they want to buy, they need sellers. When they want to sell, they need buyers. The easiest way to create this liquidity is to push price to levels where retail traders have placed their stop losses, trigger those stops, and use that liquidity to fill their orders.

Why Liquidity Grabs Are Profitable

- Predictable Pattern: Occurs at the same key levels repeatedly

- High Probability: Institutions need liquidity, so grabs happen frequently

- Excellent Risk-Reward: Tight stops with large profit potential

- Clear Entry Signal: The reversal after the grab is obvious

Where Liquidity Grabs Occur

Institutions target specific levels where they know retail stop losses are clustered. Learning to identify these liquidity pools is the first step in trading liquidity grabs.

Common Liquidity Pool Locations

- Equal Highs/Lows: When price forms multiple swing points at the same level, stops cluster just beyond

- Previous Day/Week Highs and Lows: Retail traders place stops beyond these obvious levels

- Round Numbers: Psychological levels like 1.1000, 1.2000, 100.00 attract stop placement

- Trendlines: Stops are placed just beyond trendlines, making them prime targets

- Moving Averages: Popular MAs (50, 100, 200) often have stops clustered nearby

- Previous Session Highs/Lows: Asian session highs/lows are frequently grabbed at London open

Pro Tip: Think Like Retail to Trade Like Institutions

To identify liquidity pools, ask yourself: "Where would a retail trader place their stop loss?" The answer is usually just beyond obvious support/resistance levels. That's exactly where institutions will push price to grab liquidity before reversing.

Anatomy of a Liquidity Grab

Understanding the structure of a liquidity grab helps you identify them in real-time and position yourself for the reversal.

Phase 1: The Setup

Price approaches a key level where stops are clustered. This could be previous highs/lows, equal highs/lows, or round numbers. The market may consolidate near this level, building anticipation.

Phase 2: The Grab

Price spikes through the key level, often with a long wick or series of quick candles. This triggers stop losses and creates the liquidity institutions need. The move is typically fast and aggressive.

Phase 3: The Reversal

After grabbing liquidity, price quickly reverses direction. This reversal is often sharp and decisive, with strong candles in the opposite direction. The level that was broken now acts as support/resistance from the other side.

Phase 4: The Follow-Through

Price continues moving in the reversal direction, often traveling to the opposite side of the range or to the next major liquidity pool. This is where CRT traders make their profits.

The Liquidity Grab Trading Strategy

Now that you understand what liquidity grabs are and where they occur, let's cover the exact strategy for trading them.

Step-by-Step Liquidity Grab Strategy

Identify Liquidity Pools

Before the session opens, mark key levels where stops are likely clustered: equal highs/lows, previous session highs/lows, round numbers, and obvious support/resistance.

Wait for the Grab

Watch for price to spike through your identified level. The grab typically happens in the first 30-60 minutes of major session opens (London 3:00 AM EST, New York 8:00 AM EST).

Confirm the Reversal

Wait for a strong reversal candle that closes back inside the range. This could be an engulfing candle, pin bar, or strong rejection wick. Don't enter on the grab itself—wait for confirmation.

Enter the Trade

Enter on the close of the reversal candle or on a retest of the grabbed level from the other side. The grabbed level now becomes support (if it was resistance) or resistance (if it was support).

Set Stop Loss

Place stop just beyond the liquidity grab wick (5-10 pips past the extreme). If price goes further, the grab failed and you want to be out.

Set Take Profit

Target the opposite side of the range, next liquidity pool, or previous swing point. Aim for minimum 1:3 risk-reward. Liquidity grabs often produce large moves.

Session-Specific Liquidity Grab Patterns

London Open Liquidity Grab

The most reliable liquidity grab occurs at London open (3:00 AM EST). Price frequently spikes to take out Asian session highs or lows in the first 15-30 minutes, then reverses sharply to establish the London session bias.

London Open Grab Characteristics

- • Occurs between 3:00-3:30 AM EST

- • Targets Asian session highs/lows

- • Reversal is typically strong and decisive

- • Sets the bias for the entire London session

- • Best pairs: EUR/USD, GBP/USD, EUR/GBP

New York Open Liquidity Grab

New York open (8:00 AM EST) often sees liquidity grabs at London session highs/lows or previous day highs/lows. This grab either confirms or reverses the London session bias.

New York Open Grab Characteristics

- • Occurs between 8:00-8:30 AM EST

- • Targets London session highs/lows or previous day levels

- • Can be influenced by 8:30 AM economic releases

- • Confirms or reverses London bias

- • Best pairs: All major USD pairs

Warning: False Liquidity Grabs

Not every spike through a level is a liquidity grab. Sometimes price genuinely breaks out and continues. To avoid false signals:

- • Wait for strong reversal confirmation before entering

- • Check higher timeframe bias—grabs work best with the trend

- • Avoid trading grabs during major news releases (too unpredictable)

- • Use tight stops—if the reversal fails quickly, exit immediately

Advanced Liquidity Grab Concepts

Double Liquidity Grabs

Sometimes institutions grab liquidity on both sides of the range before establishing direction. Price spikes up to grab buy-side liquidity, reverses down to grab sell-side liquidity, then makes the real move. These are trickier to trade but offer excellent opportunities if you wait for the second grab.

Liquidity Grab + Order Block Combo

The highest probability setups occur when a liquidity grab reverses into a key order block. After grabbing liquidity, price returns to an institutional order block where more orders are waiting. This creates a powerful confluence for entries.

Fair Value Gap After Liquidity Grab

Strong liquidity grab reversals often create fair value gaps (imbalances) as price moves aggressively away from the grabbed level. These FVGs can be used as additional entry points if you miss the initial reversal.

Common Liquidity Grab Mistakes

❌ Entering Too Early

The biggest mistake is entering during the grab itself, hoping to catch the reversal. Wait for confirmation. Many grabs extend further than expected before reversing.

❌ Ignoring Higher Timeframe Context

Liquidity grabs work best when they align with higher timeframe bias. A bullish liquidity grab (grabbing sell-side liquidity) in a strong downtrend is less reliable than one in an uptrend.

❌ Using Wide Stops

The beauty of liquidity grab trades is tight stops. If you're using wide stops, you're doing it wrong. Stop should be just beyond the grab wick—if price goes further, the setup failed.

❌ Taking Profits Too Early

Liquidity grab reversals often produce large moves. Don't exit at 1:1 when the setup can easily give you 1:3 or 1:5. Let your winners run and trail your stop.

Conclusion: Profit from Institutional Manipulation

Liquidity grabs are not market manipulation in the illegal sense—they're simply how large institutions operate in the market. By understanding this reality and learning to identify these patterns, you can position yourself on the right side of institutional order flow.

The key is patience. Wait for the grab to occur, wait for strong reversal confirmation, and then enter with confidence. Use tight stops and let the trade run to significant targets. Liquidity grab trading offers some of the best risk-reward ratios in CRT trading.

Start by focusing on London and New York session opens, where liquidity grabs are most reliable. Mark your key levels before the session, watch for the grab, and be ready to act when the reversal confirms. With practice, you'll develop an eye for these setups and they'll become one of your most profitable strategies.

Master Killzone Trading

Explore our complete Killzones Trading Hub for more liquidity-based strategies and institutional trading techniques.

Visit Killzones Hub

About VaderDan

Professional trader specializing in Candle Range Theory and institutional order flow. With over 30 years of trading experience, VaderDan helps traders understand market structure and develop mechanical trading systems through detailed educational content.

Learn more about VaderDan